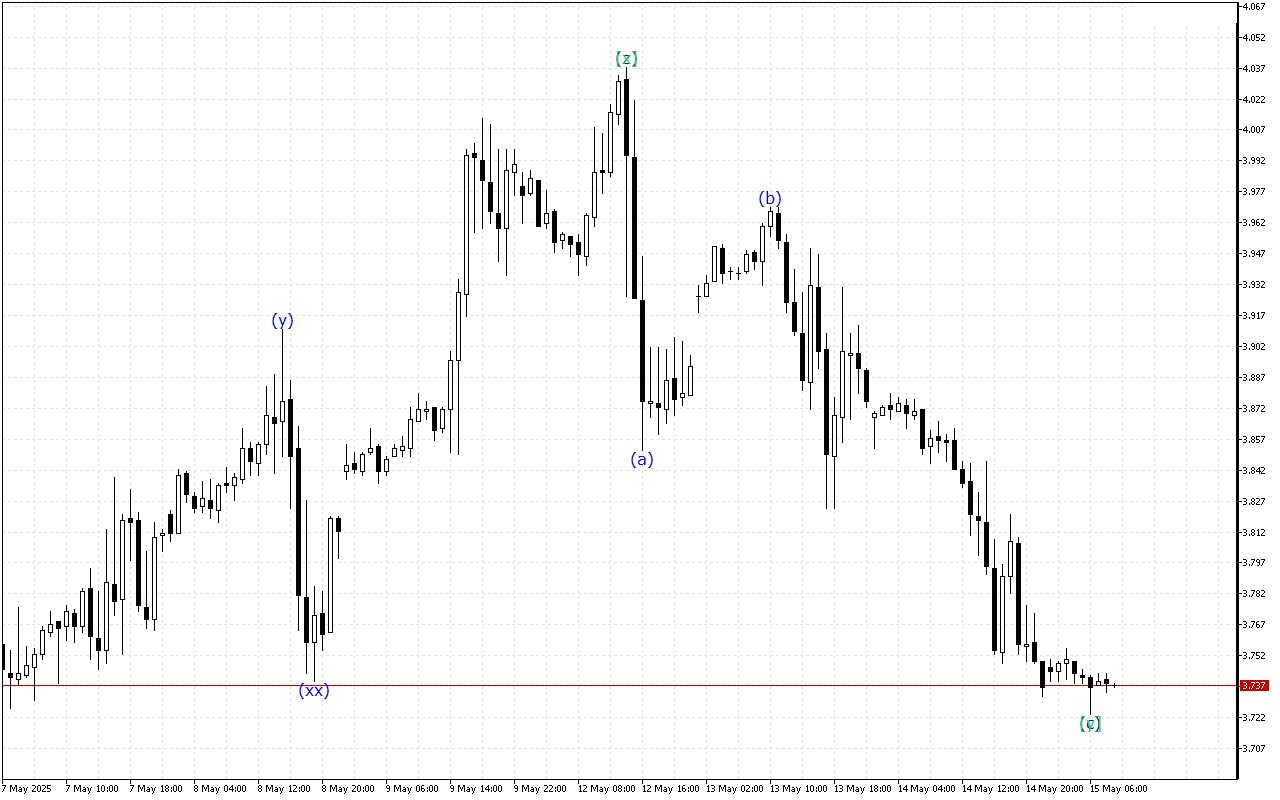

The Natural Gas chart shows the continuation of mixed trading dynamics, reflecting the general uncertainty on the market.

An analysis of the higher wave structure shows the formation of a WXY double three, with the development of the final wave [y]. After this, the development of a more directional price movement or the formation of a more complex five-wave structure can be expected.

Lower-degree waves indicate the formation of a downward ABC zigzag. The wave (c) must have already been completed, so the formation of a new wave structure can be expected.

Analysis shows that the market dynamics are characterized by mixed signals over a longer distance. In such conditions, it is worth waiting for the current wave to complete its formation.

In the current situation, it’s wise to hold off on making any trading decisions.

Natural Gas H1: Wave Analysis for the European Session on 15.5.2025